How the tax office looks at agency agreements. How are decent onshore companies used in offshore agency schemes? Agency scheme in tax optimization

An agency agreement is a consensual, mutual and remunerative act, according to which the agent undertakes to perform actions in favor of the principal, and the principal undertakes to pay for these actions.

Tax accounting of such agreements has its own distinctive properties. For tax purposes, it does not matter whether the agent acts on behalf of the principal or on his own. Under the terms of the contract, the principal undertakes to compensate the agent for all expenses. They are paid separately from and have no relation to it (Article 1001 of the Civil Code). A party to an agency agreement can be either an individual or a legal entity.

Features of taxation and fees

At the agent's

By agreement, the agent must provide the principal. If the terms of the contract do not specify the procedure for reporting, then the agent does this as the clauses of the contract are fulfilled or after its full implementation.

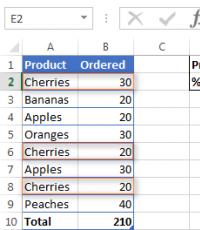

To implement the scheme, the wholesaler sells all or part of the product through simplifiers. At the same time, simplifiers have restrictions (Article 346.13 of the Tax Code):

- by amount of income;

- at residual value;

- by number of employees.

To overcome these limitations, it is enough to use the business fragmentation method, that is, to cooperate with several simplified companies. Such entities collect the maximum part of the profit from transactions, from which a single tax of 15% is paid (in some regions it can be 5% according to clause 2 of Article 346.20 of the Tax Code).

Applies with 6% tax. You can use two object options at the same time: for some agents, select “Income,” and for others, select “Income minus expenses.” This method may not be beneficial to buyers who pay VAT. But even if the number of buyers who do not pay VAT is 10% of the total turnover of goods, expenses during fragmentation generate income.

- You can attract companies using discount systems, deferred payments, and so on. Attracting clients who do not pay VAT is quite a difficult task. The easiest place to find them is in the consumer goods retail environment. Such clients can be reached even when concluding transactions with buyers who pay VAT. They help attract buyers and at the same time become agents or subagents themselves. Such agents and subagents will be required to provide remuneration or additional benefits.

- Another option for a significant reduction in VAT and income tax is to transfer turnover off the balance sheet by switching to the simplified tax system. This is expressed in the fact that instead of selling, the company becomes an intermediary between external contractors and.

- The bottom line is that income previously generated from trade markups now comes in the form of agency fees. At the same time, additional income is received in the form of del credere payments. There is no need to calculate and pay VAT and income tax on such income.

- An agency scheme is also used with a non-resident principal having two agents: one, on his behalf, purchases goods, the other sells. There is no provision for payment of income tax, since a non-resident does not have a representative office in the Russian Federation, and therefore no property. However, VAT must be withheld. But if you register a non-resident for tax purposes in Russia, you will be able to transfer it to him.

- The introduction of various cost mechanisms helps reduce profits. For example, in sales you can use individuals to assist in raising or returning funds, searching for counterparties, and using collection services.

- Revenue from wholesale sales can be represented as revenue from retail sales. This helps you avoid paying VAT and profit tax on the turnover of wholesale products.

Tax optimization for AD is described in this video:

We continue the series of articles devoted to offshore schemes. Today we will look at schemes in which a British company can be used.

Agency scheme in tax optimization

Before describing the most classic offshore agency scheme, I would like to talk a little about the organization of the agent’s activities from the point of view of English law. So, according to UK legislation, tax is NOT levied on agency fees exclusively and only if a number of conditions are met in total:

- A British company is owned by a non-resident of the country.

- The company does not conduct business in the United Kingdom of Great Britain and Northern Ireland.

- The company specializes in providing intermediary, management and agency services.

In most cases, a British company is an agent of a foreign company established in a tax-exempt jurisdiction. The English company, on its own behalf, for a small compensation, carries out activities on the world market, as specified in the agency agreement. Russian companies use a nominal British company when carrying out export-import transactions to optimize taxation through the principle of transfer pricing, as well as re-invoicing.

The main advantage of using such a scheme is the prestige of the country where the agent company was founded. When registering a principal enterprise in the territory of a classic offshore, no tax is levied on profits, but remuneration transferred to a British institution is subject to taxation. In the UK, income tax is 30%.

It is worth noting one important point: for this offshore scheme to work, it is necessary to hide the affiliation of the UK agent company and the principal company in an agency agreement established in a classic offshore, for example, on the island.

Let's look at an example of how this scheme works:

A Russian company supplies goods to a British agent company for transfer to a foreign buyer. The buyer transfers funds for the goods to a British company ($500). The UK company remits to the Nevis principal the fee from the foreign buyer less the fee ($495). The principal company transfers funds to the agent company for the transfer to the Russian company minus funds for the maintenance of the company ($400). As a result of using this scheme, with a deduction of 30% tax on the remuneration of the UK company and no taxation in Nevis, the net profit of the principal company will be 98.5%.

The main thing here is not to overdo it, but to use the rule of thin capitalization and remember that the Agent’s activities must make economic sense.

Using a UK registered partnership

By using a British partnership in an offshore scheme, you can avoid corporate tax, that is, the income of partners is subject to taxation at their place of residence. Therefore, if the partners are classic offshore companies established in tax-free jurisdictions, for example, Nevis, and the partnership itself does not operate in the UK, taxation can be completely avoided. It is recommended to use nominee companies in this scheme, which will significantly save money. Such schemes have shown their best performance in the trading area of activity.

You can read more about the partnership in materials such as:

What other partnerships can be used instead of British ones?

It is worth noting the fact that instead of a UK partnership, a partnership or partnership registered in .

Intermediary services, even with all the transparency of relations between counterparties, always become the object of bias on the part of the tax authorities. The reason for the increased attention is that this type of relationship is often used in various methods of tax optimization. The most dangerous of them are those that involve the use of “one-day” ones.

In the standard scheme, a fictitious organization plays the role of an agent. As a rule, this is done not so much to inflate expenses for profit tax purposes and increase input VAT, but to cash out funds.

“Some circuit designers recklessly store constituent documents, forms, seals and reports of counterparties in their offices”

THE PRINCIPLE IS REAL, THE AGENT IS FICTIONAL

When checking, tax authorities, seeing agency fees as part of the expenses, immediately check the counterparty for signs of a “fly-by-night”. It is in cases where the agent exists only on paper (for sufficiently large amounts of transfers) that serious tax sanctions or criminal liability follow.

So, in one of the previous issues "PNP" it was told how the metropolitan police exposed the Industrial Savings Bank * in cashing out money, and after that, along the chain, they were able to prove the guilt of the directors of the companies that used cashing out of tax evasion. In several criminal cases, the accusation was that taxpayers transferred funds under the guise of agency fees to fly-by-night companies. As a result, company leaders were punished with fines and suspended sentences.

EXPERT COMMENT

Vadim YAGUDIN, expert on organizational and tax design of Ardashev and Partners Law Firm LLC:

- Despite the fact that the popularity of “one-day” schemes has noticeably dropped, many are in no hurry to part with an easy tax optimization tool. Often, organizations using such schemes are limited to drawing up formal standard agency agreements and agent reports using general vague language.

Some circuit engineers recklessly store constituent documents, forms, seals and reports of counterparties in their offices, keep records of their activities and the activities of counterparties on the same computers, send reports by mail from one post office or submit them via telecommunication channels from one IP addresses. As practice shows, if inspectors identify the facts described above, then the taxpayer has practically no chance to prove his good faith.

The danger of schemes with fly-by-night agents is confirmed by both arbitration practice and reviews of taxes for official use**, which describe typical methods of cashing out and inflating VAT deductions.

In this sense, the resolution of the Federal Arbitration Court of the West Siberian District dated 04/07/08 No. F04-2346/2008(3418-A27-41), in which the court sided with the taxpayer, can be considered an exception that confirms the rule. Nevertheless, it makes it clear what evidence tax authorities can collect in order to regard the agency agreement as fictitious.

So, after an on-site audit, tax officials accused the Kemerovo Center KAMAZ company of using a chain of “economic connections of agents to increase their expenses in order to reduce their tax liability for VAT in the form of obtaining a deduction for “input” VAT.” As follows from the court decision, the inspectors’ suspicions were caused by the payment of agency fees in the amount of 61 thousand rubles. companies "SpetsKomplekt" and "StroySib", which helped the taxpayer find buyers for KamAZ trucks.

Tax officials conducted counter-inspections of client organizations that were allegedly found through agents. From the responses to inquiries and explanations received by the police at the request of the inspectorate, the tax authorities concluded that the agents did not provide any services. Further, the inspectors found that the agents are not located at their registered addresses, do not have property or personnel, do not pay taxes, do not submit reports, and the citizens indicated in the constituent documents as managers are not such. According to the inspectors, there was no documentary evidence of agency services: applications, agreements between agents and buyers, documents confirming the costs of finding buyers.

Finally, the tax authorities also presented the results of a handwriting examination, which concluded that agency agreements (on the part of the agents) were signed by unidentified persons.

As a result, the tax authorities decided that in all transactions for the purchase and sale of vehicles (there were about 300 of them) with the participation of agents, the services of intermediaries were fictitious. Therefore, the total amount of additional accruals to the company amounted to more than 12 million rubles. VAT plus penalties and fines in the amount of RUB 2.58 million.

However, the court rejected all the controllers' arguments. Firstly, the court referred to the fact that, having carried out a random inspection of transactions involving agents, the inspectorate unlawfully extended its conclusions to all transactions.

Secondly, according to the court, the taxpayer clearly explained why there is no formal evidence (contracts and “financial relations”) between agents and buyers of KamAZ vehicles. The company, in particular, referred to its provision, according to which information about the services provided by agents is recorded in any form by the principal’s employees during a calendar month.

The court excluded the buyers' explanations obtained by the police as being obtained outside the scope of the on-site inspection. The court did not accept the handwriting expert’s conclusion on the basis that the expert’s data was not indicated in the decision ordering the examination.

As a result (incredibly!) the company won the case and defended the VAT deduction.

In most cases, courts refuse to deduct VAT and recognize expenses under agency agreements and for smaller sins. At the same time, inspectors do not bother collecting all the evidence that was collected in the described case. For example, in the case described in the decision of the Federal Arbitration Court of the North-Western District dated 02/07/08 No. A56-30016/2006, the taxpayer was unable to prove the fact that services were provided to him. Inspectors discovered that the principal transferred large sums to the agent for assistance in searching and consulting in the sale of real estate. In turn, the agent delegated this work to another intermediary. However, the company did not provide documents confirming the services of agents.

OFFICIAL POSITION

Alexey ALEKSEEV,

- Schemes where the agent is a shell company are very often used in practice. They are usually not particularly difficult to prove, and in certain cases companies agree to remove expenses or VAT deductions without taking the case to court. Difficulties may arise if there are many such agents or transactions follow a chain from agent to agent.

Having carried out a random inspection of transactions involving agents, the inspectorate unlawfully extended its findings to all transactions

The reasons for this change are obvious. Having come to check the agent, it is not a fact that the tax authorities would verify the existence of the principal. Rather, they would look to the end buyers to ascertain whether transactions had actually taken place.

OFFICIAL POSITION

Alexey ALEKSEEV, Advisor to the State Civil Service of the Russian Federation, 3rd class:

- The likelihood that, when checking an agent, the tax authority will be interested in the principal directly depends on the purpose of the audit and the amount of VAT deductions that ultimately go to the principal. If we are talking, for example, about a thematic verification of an agent’s payment of income tax, then the goal will be mainly to record the amounts of remuneration and pay tax on them. In this case, it is unlikely that the inspector will go further and become interested in the principal under the agency agreement. If the audit is comprehensive and large amounts of VAT are involved, then the principal will certainly become the object of attention.

A business organization carries out actions determined by its goals, relying on economic power and control of material and financial transactions. The organizational structure of economic activity highlights power relations that provide methods and means of achieving set goals. Under power relations usually refers to the transfer by an individual, collective or group of decision-making power, either explicitly or implicitly, as a result of a simple agreement or contract, to a specific person or body.

Example

The owner of a property share (or specific material assets), by contributing his share to the authorized capital, delegates his power to the bodies authorized to manage the created company.

Powers are distributed across hierarchy levels, i.e. within the framework of strictly defined economic and social relations. There are relations of power and hierarchy. Hierarchy leads to subordination of powers. The top level is vested with the rights to control a set of management procedures, the purpose of which is to ensure its role in decision-making and their implementation.

The rules and mechanisms of financial institutions and the contradictions between economic (i.e., profit-oriented) and bureaucratic (order-oriented) management contribute to overcoming conflicts of economic interests.

Principal-agent model

The difference of interests and the factor of responsibility determine economic relations by the interrelation of the main elements of the “principal-agent” hiring model. In broad terms, it covers the relationship owner - manager, manager - subordinate, customer - contractor, in which principal plays the first role in the operation of a certain system, but delegates operational control over this system agent. Any economic entity can be represented by a chain of principal-agent relationships. The number of links depends on its organizational structure.

The emergence of the problem of relations comes from the interests of the initial division of property rights between possession, realized through the acquisition of shares and subsequent receipt of dividends, and by order, which manifests itself in the current functioning of the organization and the remuneration of performers.

Further development of relations is built on the information exchange of the owner - manager (tone manager) - manager (boss) - performer. Each level includes many stages of generating qualitatively new information that accompanies the decision-making process within the organization. It is important that only those who are directly involved in its receipt and processing possess qualitatively new information. Obviously, the lower level has more information about the actions it performs than the higher level. Those who are closer to the production process have more information about the actual state of affairs. Their behavior in transmitting information determines the completeness and reliability of the chain of command. As the organization grows, the complexity and specialization of the information circulating in it occurs, which is not accompanied by an adequately efficient pricing mechanism for providing information. The emerging asymmetry of information deepens the conflict between the principal (profit maximization) and the agent (quiet existence, prestige, professional development) and gives rise to problems.

Principal's dilemma consists in choosing between the need to control the agent and the unwillingness to bear the costs associated with the implementation of control, being interested in obtaining information utility.

Agent's dilemma is a choice between the desire to maximize one’s utility and the need to fulfill the obligations assumed when signing the employment contract, i.e. be satisfied with a certain fixed level of utility that comes from possessing unique information.

The agent may not be interested in its distribution at all and in its undistorted transmission to the principal. It has been noted that a competent employee may be interested in working slowly, but without causing the employer to doubt his integrity. This creates the preconditions for opportunistic behavior of agents. Therefore, the principate-agent problem is regarded as a special case of a moral hazard situation.

Example

The principal is an investor in environmental protection measures against “natural” hazards, and the agent is an investor in their prevention, who benefits from asymmetry of information, even misinformation about possible phenomena that could cause harm.

Competition in the market stimulates the dissemination of reliable information. In ordinary principal-agent relationships, by contrast, information asymmetry and the prospect of opportunism encourage manipulation by the uninformed principal. By the way, it is from this point of view that most crimes in the economic sphere should be interpreted: as an opportunistic desire of agents to participate in appropriating the results of their activities.

Example

The project manager is looking for the optimal capital investment scheme, striving for the expected benefit. Due to behavioral characteristics, the subordinate provides limited information on a selection of options, which leads to a decision to abandon the project.

An increase in the size of an organization entails an increase in the costs of the principal to control the actions of an increased number of agents. Having received through the employment contract guarantees of a fixed remuneration in the event of “natural” contingencies, there will be those who seek to create “artificial” contingencies that would allow, through manipulation of the principal, to redistribute the results of activities in their favor.

Example

The agent misleads the principal regarding the actual complexity of the task assigned to him to perform. Under many circumstances, there is a temptation for workers to work less than fully. The situation is known as the “free rider problem.”

With an increase in the volume of output, the number of personnel and the number of separate operations of the production process increase, and the direct connection between labor and its result, characteristic of small-scale production, is lost.

If the right to control the activities of agents is delegated on a functional basis - to the heads of functional departments (sales department, chief engineer, chief accountant), then they become both agents - in relation to the main office, and principals - in relation to the direct executors of tasks.

In a number of proceedings, the participation of agents in the results of activities is allowed, and the functions of the principal themselves begin to be performed alternately by agents. The principal becomes "temporarily first among equals." At the same time, power relations and delegation of control over their actions by agents do not disappear, only the functions of control and distribution of tasks are performed in turn by all participants in the organization. Rotation of agents in the position of principal solves the problem of incentives to transmit only reliable information; most importantly, it creates the prerequisites for trusting relationships between agents and, with their help, achieving cooperation, an “associative atmosphere.” The form of existence in practice is self-government.

The positive effect of cooperation is due to the very fact of teamwork and mutual support of firm members. Performance results depend on the size and organization of firms.

In a firm as a coalition of agents, it becomes possible to solve the problem of principal and agent based on three strategies:

- "golden rule" which requires the principal to reward agents in accordance with their contribution to the overall result, and from the agent to conscientiously perform the tasks set by the principal;

- equal effort standard that on the part of the principal it is to apply a fixed equalizing payment to agents, and on the part of the agent it is to work “like everyone else”, no better and no worse;

- opportunistic behavior, which on the part of the principal can, for example, be expressed in an underestimated remuneration of the agent under the pretext of unfavorable “natural” conditions, for example, market conditions, when the agent does not have all the information about the situation on the market.

The focus on maximizing profits in conditions of prices for all products set by competition and the cost structure described by the production function is determined by the interests of the principal - the owner, the shareholder. The amount of profit is entirely determined by the actions of agents and hired managers, which determines the “principal-agent” relationship between managers who are principals in relation to hired workers.

The nature of conflicts within an organization cannot be reduced only to the opposition of interests of the principal and the agent. The structure of production and sales links is subordinated to the task of minimizing transaction costs.

The “principal-agent” relationship focuses on the prerequisites (motives) of contracts (ex ante), and the minimization of transaction costs focuses on already implemented agreements (ex post), giving rise to various management structures and methods of action.

Solutions to the problems of organizing the work of a large firm lie at the heart of the principal-agent relationship and alternative models of internal structure.

Today, a market of organizational forms is emerging, in which firms with different organizational structures compete. The prosperity of the best and the extinction of the worst organizational forms are ultimately determined by their ability to ensure savings in transaction costs. Competition in this market can be indirect and expressed in the struggle to attract and retain the most productive members of the team. But it can also be direct, when some firms try to take over (absorb) others.

Thus, each organizational form has features in the production of marketable products and a set of transaction costs, which, under certain conditions, can turn it into the most effective. In achieving the main goals, essential importance is attached to the analysis of the internal and external environment.

In comparison, we can distinguish several fundamental types of organizational structure of companies)